A PIONEER

of digital asset management

Employs leading advanced trading strategies and technologies

DIA Metaverse Fund SP

Objectives

Cryptocurrencies provide a new investment opportunity which is uncorrelated with traditional assets.

Therefore, our fund aims to capture the alpha in this nascent investment/trading asset class. The fund aims to provide exposure to the favourable price movements of a basket of cryptocurrencies while managing the risks associated with them.

Key Characteristics

Uncorrelated Returns

Returns are uncorrelated with traditional assets. Cryptocurrencies have demonstrated great volatilities in the past. Our trading algorithms are designed to be market-neutral so as to capture the volatility of the price movements of cryptocurrencies while avoiding the directional movement.

Algorithmic / Quantitative Strategies

Strategies are developed with advanced algorithms which capture the arbitrage opportunities in cryptocurrencies across various time horizons. Strategies are executed in an automated manner so as to minimize human intervention in the trading process, as well as capture as many trading opportunities as possible while maintaining objectivity in trade execution.

Insured Custodian

The team works with leading experienced custodian of digital assets and utilizes a whole range of security measures to safekeep the clients’ digital assets. In addition, digital assets stored in cold wallets are insured with extensive insurance policy.

Basket of Cryptocurrencies

Diversify / avoid single currency risk Mainly trade / invest in major 8 cryptocurrencies.

Experienced Team

The trading team has more than 30-year experience in trading various traditional asset classes, including equities, ETF, forex, options, etc.

In-house Proprietary Trading Systems

We utilize state-of-the-art proprietary software and advanced valuation models that allows our trading algorithms to be one of the most competitive in the major cryptocurrencies.

Quick Facts

| Fund Name | DIA Metaverse Fund SP |

| Asset Class | Metaverse and Artificial Intelligence (AI) related companies and projects |

| Type of Fund | Equity and Cryptocurrencies |

| Fund Size | US$100,000,000 |

| Launch Date | October 20, 2023 |

| Base Currency | USD |

| Base Value | 100 |

| Financial Year End | December 31 |

| Minimum Investment | US$10,000 initial, US$20,000 additional |

| Minimum Holding | 10,000 |

| Shares Unit Dealing Frequency | Monthly |

| Lock-up Period | 24 months |

| Management Fee | 3.5% per annum of NAV |

| Redemption Price | Up to 300% of Investment |

| Subscription Fee | Up to 5% |

| Subscription Day | The 10th business day* of each month (subscription request must be made at least 10 business days* prior to this) |

| Redemption Day | The 10th business day* of each month (redemption request must be made at least 10 business days* prior to this) |

| Distribution Of Profit | Through panel USDT-linked Master Card user account |

Crypto Exchanges

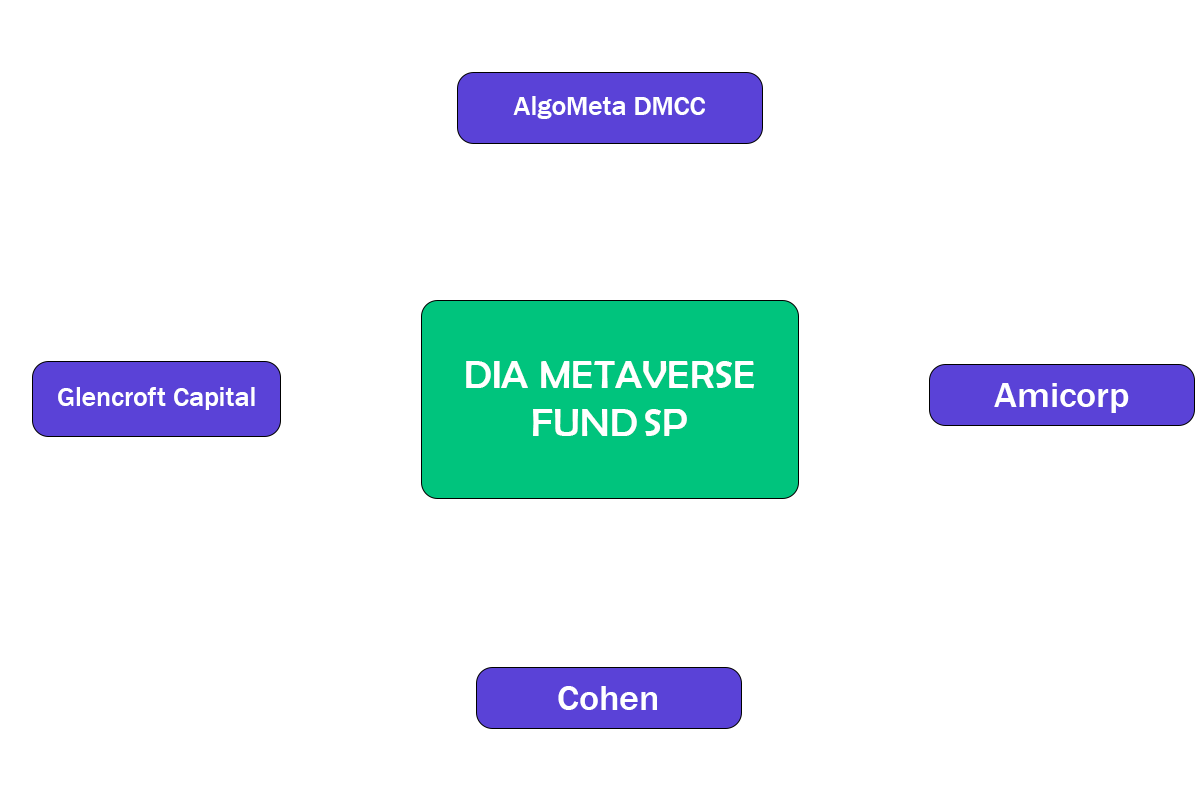

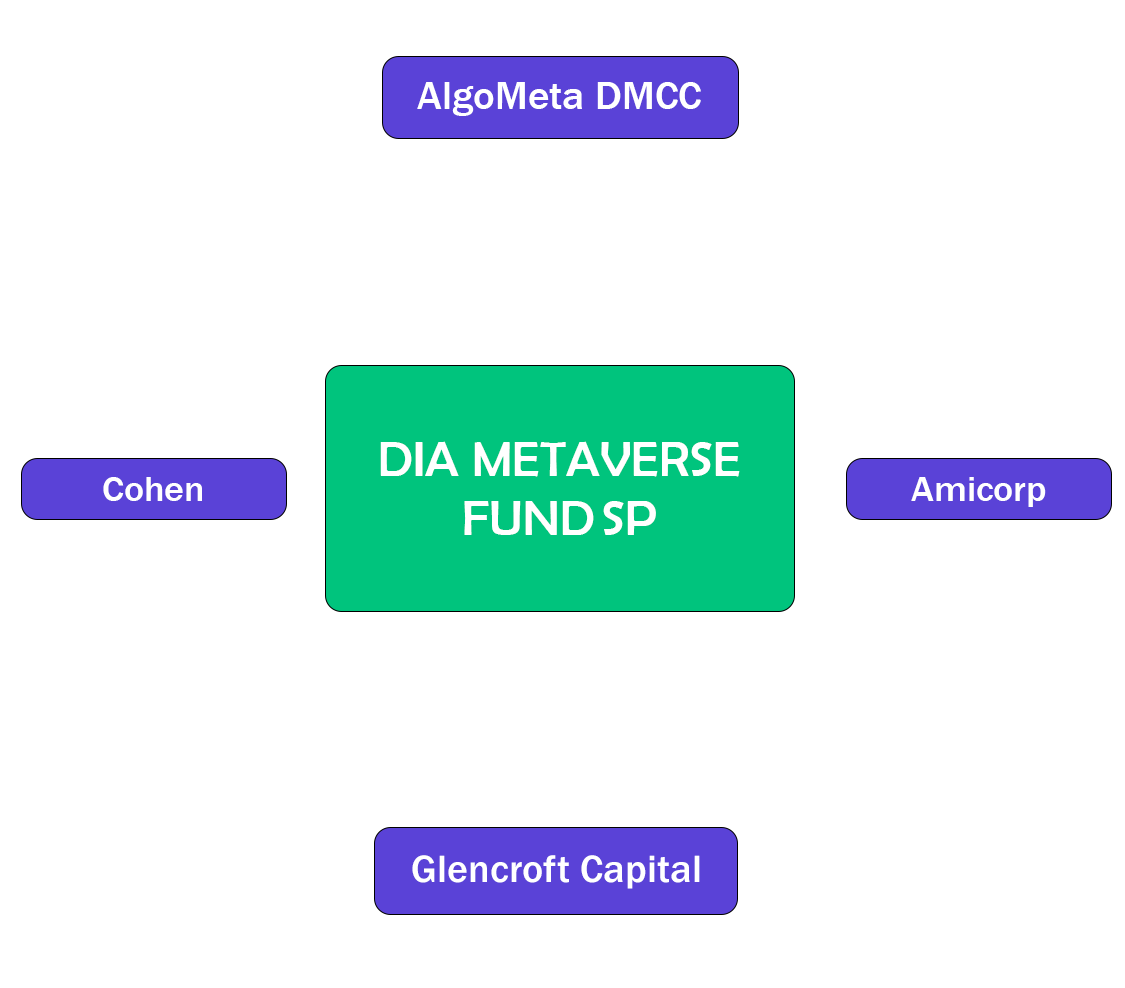

Fund Structure

Team

Jingyuan Ye, CFA

Jingyuan has over 10 years of experience in financial services industry. He joined Bank of America Merrill Lynch in London 2007 as the Vice President of Global Market Division, where he was responsible for the risk and portfolio management of OTC and listed equity structured products for EMEA. Currently he is the Chairman and co-founder of DIA Metaverse Fund SP.

Lin Cheung

Lin has more than 10 years of experience in trading technology and operations. Previously he was a senior vice president of JPMorgan Chase and responsible for managing an application development team covering Asian electronic trading businesses across multiple asset classes. Lin is the CEO and co-founder of DIA Metaverse Fund SP.

Roy Seto, CFA, FRM, ASA

Roy is a seasoned trader specialized in high-to-medium frequency quantitative strategies. Previously he had set up systematic trading desks in a proprietary trading firm in Korea as well as a family office in Hong Kong. He is currently the CIO of Glencroft Capital overseeing the firm’s investment portfolios.

Mike Wang

Mike has over 10 years of extensive experience in quantitative trading. Before joining DIA Metaverse Fund SP, Mike was a senior director who managed the quantitative trading desk in the headquarters of Guotai Junan Securities (GTJS), and was responsible for the research and implementation of their machine learning-based quantitative trading strategies. He is currently the CIO and co-founder of DIA Metaverse Fund SP.